SBI Funds Management Ltd (SBIFML), the asset management arm behind India’s largest mutual fund, SBI Mutual Fund, has taken its first step toward a highly anticipated initial public offering (IPO). The company has begun the process of appointing merchant bankers and other key service providers to facilitate the planned listing, signalling progress toward a targeted 12-month timeline for going public, as stated by SBI Chairman C S Setty.

About SBI Funds

SBI Funds Management is the largest mutual fund manager in the country with assets of nearly 12 lakh crore rupees as of September 2025. It commands about 15.5 % of the Indian mutual fund market. SBI holds a 61.98 % stake in the company, while France-based Amundi owns 36.40%.

The company managed a Quarterly Average Assets Under Management of Rs 11.99 lakh crore and reported total AUM of Rs 16.32 lakh crore as of September 30, 2025, which reflects its scale and strong investor trust. Its financial performance also highlights this growth, as it generated total income of Rs 4,230.92 crore in FY25.

Structure of the Proposed SBI Funds IPO

The upcoming IPO is expected to be an offer for sale. Under this structure, existing shareholders sell part of their stakes instead of issuing new shares. SBI plans to sell 3,20,60,000 equity shares, which represent about 6.3007 %of the company. Amundi plans to sell 1,88,30,000 shares or about 3.7006 %. Altogether, about 10 % of the company’s equity will be offered to public investors.

Supportive Market Environment

If executed as planned, the offering will be one of the more prominent listings in the financial sector. Analysts view the IPO as an opportunity for SBI and Amundi to unlock value from their investment. It will also give investors access to a dominant asset management company at a time when mutual fund participation is increasing across India.

The planned listing comes at a time when Indian equity markets remain active with strong retail participation. Financial sector IPOs have drawn attention as companies look to raise visibility and support long-term growth. A successful listing for SBI Funds Management could influence valuation benchmarks across the mutual fund industry.

Next Step For SBI Funds IPO?

The next key step is the formal selection of merchant bankers. By bringing merchant bankers on board, SBI Funds Management is engaging the specialists who will oversee crucial elements of the IPO, including due diligence, valuation, preparation of regulatory documents and coordination with SEBI and stock exchanges. After this, the company will work toward preparing its draft red herring prospectus for filing with the Securities and Exchange Board of India. Pricing details and subscription timelines will follow. If progress continues smoothly, the firm could list in the public markets within the next year.

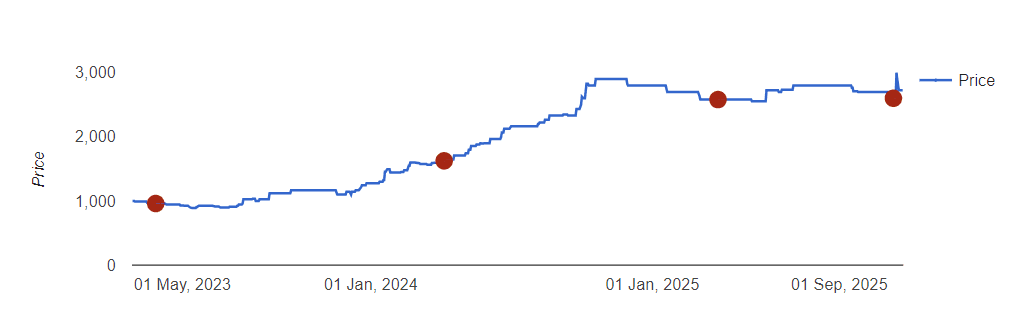

SBI Funds Management Unlisted Share Growth

In November 23, the SBI Mutual Fund Unlisted Share Price was trading around Rs 1100 per share. In 3 years, the price increased to Rs 2,700, marking an almost 2.5X growth in just 2 years. Currently, the share is trading around Rs 2730. This growth can be primarily attributed to the primarily by strong financial performance and industry leadership.

Should You Invest In Pre-IPO SBI Mutual Funds?

If you are exploring pre-IPO opportunities, SBI Mutual Fund’s unlisted shares present a compelling financial story. The company’s revenue has expanded from Rs 2,412 crore in FY2023 to Rs 4,236 crore in FY2025, while profit after tax increased from Rs 1,329 crore to Rs 2,540 crore over the same period. Return ratios such as ROE of 30.5% and ROA of 28.9% further reflect the strength of the underlying business. These numbers highlight how meaningful value can be built well before a company lists on the stock exchanges.

At the same time, pre-IPO investing requires patience and a clear understanding of liquidity and valuation dynamics. Tracking SBI Mutual Fund’s financial performance and listing progress can help investors evaluate how such unlisted opportunities unfold as they move closer to the public markets.